We may receive advertising compensation when you click certain products. Before jumping into this page, an important disclosure.

Popular Exchanges to Buy Bitcoin & Crypto in Switzerland

| Popular Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply. | eToro - Supports Bitcoin, Ethereum & 15 other coins

- Start trading fast; high limits

- Deposit with SOFORT, SEPA, Klarna + more

Fees: 1%  Account Minimum: $50  Promotion: None | BUY NOW at eToro's Secure Site |

| | Coinbase - High liquidity and buying limits

- Easy way for Swiss users to get crypto

- Deposit with SEPA, SOFORT, IDEAL, card

Fees: 0% - 0.50%  Account Minimum: None  Promotion: Earn $5 | BUY NOW at Coinbase's Secure Site |

Coinbase

Coinbase is one of the largest Bitcoin (BTC) and cryptocurrency brokers in the world. They represent an easy and fast way for new users to purchase crypto, with special support for Swiss customers.

Customers in Switzerland can purchase bitcoins with:

- SOFORT

- Credit & debit card

- bank transfer

- SEPA transfer

- iDEAL

Pros

- High liquidity and buying limits

- Easy way for newcomers to get bitcoins

- "Instant Buy" option available with debit card

Cons

- Purchases made with bank transfer can take up to 5 days to complete

- Coinbase may track how and where you spend your bitcoins

Ease of Use

Easy

Privacy

Low

Speed

Average

Fees

Average

Reputation

Trusted

Limits

High

Bitstamp

Bitstamp, founded in 2011, is based in the UK but offers support for customers in Switzerland. We researched and found that in 2019, Bitstamp formed a special partnership with Dukascopy. This allows Swiss customers fast transfers.

Pros

- One of the longest-running Bitcoin exchanges

- Very low 0.25% fee, falling to 0.1% with sufficient trading volume

- Offers wide range of altcoins

Cons

- High 8% fee on small credit card purchases, falling to 5% with sufficient trading volume

Ease of Use

Hard

Privacy

Low

Speed

Slow

Fees

Average

Reputation

Trusted

Limits

High

Coinmama

Coinmama allows customers in Switzerland to buy bitcoins, litecoins, ethereum and many other coins with a credit or debit card, SEPA, bank transfer, or SOFORT.

They charge a 4.9%-5.9% (depends on volume) fee on credit card purchases.

Customers in Swizerland can also purchase cryptocurrency with SEPA or SOFORT for a lower fee.

Pros

- Works in almost all countries

- Highest limits for buying bitcoins with a credit card

- Reliable and trusted broker

Cons

- Some of the highest fees among credit/debit card bitcoin brokers

Ease of Use

Easy

Privacy

Low

Speed

Fast

Fees

Average

Reputation

Trusted

Limits

High

Bitcoin Suisse

Founded in 2013, I've observed Bitcoin Suisse's decade-long excellence as Switzerland's premier Bitcoin exchange. We appreciate their secure cold storage, Bitcoin Suisse Vault, and the safeguarding guarantee from a Swiss Bank. Their staking service and loan solutions leverage crypto assets efficiently.

Pros

- Trused Swiss exchange founded in 2013; trusted crypto industry pioneer.

- CHF 95+ million in equity capital.

- Partnerships, ETPs, Ethereum scaling, decentralized identity integrations.

Cons

- Better for experienced buyers in CH

Ease of Use

Average

Privacy

Low

Speed

Fast

Fees

Low

Reputation

Trusted

Limits

High

Coinbase Pro

Coinbase's exchange, Coinbase Pro, is one of the largest Bitcoin exchanges in the United States. Users can fund their accounts via bank transfer, SEPA, or bank wire. Coinbase Pro offers good prices and low fees, but their confusing user interface may initially prove difficult to navigate.

Pros

- Some of the lowest fees available for US and EU customers

- Possible to buy bitcoins for 0% fees

Cons

- User interface is confusing for first time buyers

Ease of Use

Hard

Privacy

Low

Speed

Average

Fees

Low

Reputation

Trusted

Limits

High

Bity

Bity is a Bitcoin exchange and ATM operator, based in Switzerland. Their 5 ATMs allow for a quick first purchase and only require phone verification for an initial buy limit of 1,000 EUR or CHF. Their online service accepts wire transfers, SOFORT and online bank transfers.

Pros

- Easy to start buying bitcoins after mobile phone verification

- Payment limit of up to €100,000 annually after intensive verification

Cons

- ID verification is required for most purchases, so not a private way to buy

- Low annual limit of only €4,000 without intensive verification

Ease of Use

Average

Privacy

Low

Speed

Fast

Fees

Low

Reputation

Trusted

Limits

High

Bitcoin ATMs

You can use our Bitcoin ATM map to buy bitcoins with cash. Bitcoin ATMs can be a quick and easy way to buy bitcoins and they're also private. That convenience and privacy, however, comes with a price; most ATMs have fees of 5-10%. View Bitcoin ATMs

Pros

- Our map makes it super easy to find a Bitcoin ATM near you

Cons

- Bitcoin ATMs often have 5-10% fees per purchase

-

Chapter 1

Bitcoin & Cryptocurrency Trading in Switzerland

Buying Bitcoin in Switzerland is pretty easy thanks to the government's crypto friendly attitude (more on that below).

In November 2022, a change by the Swiss financial regulator will require customers to prove their identity if they make transactions that total 1,000 Swiss francs ($1,000) or more over a monthly period when they swap crypto for cash or another anonymous form of money. In a report issued by the Financial Market Supervisory Authority (Finma) said “Virtual currencies are often used as a payment instrument for illicit trade, notably in drug trafficking, on the darknet, or for the payment of ransoms after cyberattacks. The risk of money laundering in the domain of virtual currency is reinforced by potential anonymity and by the speed and cross-border nature of transactions.” This concerned citizens and crypto companies that the change is burdensome on customers and makes storage of customer data prone to hacking.

Zurich, the economic safe-haven to the world

But before you sign up with an exchange, make sure you have a secure hardware wallet like a Coldcard or TREZOR.

Although Bitcoin's blockchain is immutable and free from hackers, the centralized exchanges from which you buy Bitcoin - like Coinbase and Coinmama - are centralized, and vulnerable to attack.

While you can probably get away with storing small amounts of Bitcoin on an exchange, it's not a good idea, especially with larger amounts.

Protecting your Bitcoin should be a top priority, which begins with a secure form of cold storage that hackers can't access.

After you get a wallet, choose an exchange, verify your identity, connect your payment method, and trade away!

If you want to buy from an exchange based in Switzerland, we recommend Bity. They're a Bitcoin ATM company based in Switzerland, with 5 ATMs that provide quick withdrawals and high limits.

Swiss Banks and Bitcoin

Switzerland's banking industry is known to safeguard wealth, which is why Bitcoin is a natural fit for the country.

Founded recently with a universal banking license, SEBA Bank AG has a plethora of services, from fiat currency storage to crypto custody (they manage your cryptocurrency).

SEBA's home page

The Swiss startup can hold a bunch of different fiat currencies, such as American dollars, Singaporean dollars, and Hong Kong dollars.

One of the coolest things about the bank is their crypto connected debit card that automatically transfers crypto on the backend to traditional currency. The card can be used in regular commercial settings, withdrawing from a cryptocurrency balance.

SEBA Bank AG is yet another testament to Switzerland's historical safeguarding of wealth, this time in the crypto sphere.

One of the easiest ways to buy Bitcoin in Switzerland is through cryptocurrency exchanges. There are several exchanges offering Bitcoin in Switzerland, allowing you to select one based on your requirements and preferences using our list outlined above. Different exchanges have different transaction fees, withdrawal limits, payment modes, and verification processes that need to be considered before selecting one.

Additionally, Bitcoin buyers need to keep in mind that certain exchanges might require you to get a wallet of your own before being able to buy the digital currency. Even if there is no requirement, it is recommended to have a wallet of your own for security reasons (preferably a hardware wallet). If you don’t have a wallet, refer to our guide on the Best Bitcoin and Cryptocurrency Wallets to choose one.

-

Chapter 3

Exchange Hacks and Crypto Scams in Switzerland

Bancor Hack

In July of 2018, the "decentralized" exchange Bancor, based out of Israel and Switzerland, announced that hackers had stolen ~$23.5M in crypto assets.

These included:

- $12.5 million in Ether

- $1 million in Pundi X’s NPXS token

- $10 million in Bancor’s BNT

This hack occurred when "a wallet used to upgrade some smart contracts was compromised", according to Bancor's spokesperson.

Bancor raised over $150M during its Initial Coin Offering the previous year.

The lesson to learn from the Bancor hack is that just because someone claims their exchange is decentralized does not mean that the wallets can't be hacked or that the software does not have critical bugs that leave customers vulnerable.

Charlie Lee, Litecoin founder, put it best:

E-Coin Scam

The Swiss Financial Market Supervisory Authority (Finma) has blocked $2M worth of funds sent to Quid Pro Quo Association for issuing E-Coins. Quid Pro Quo claimed that E-Coin was a cryptocurrency, yet it was discovered that there was no Blockchain, and the coins simply existed on a database held on Quid Pro Quo's servers.

According to the statement from Finma,

These three legal entities accepted funds amounting to at least four million Swiss francs from several hundred users.

Finma

Spokesperson The scheme also promised to back the coins with physical assets, which it had failed to do. There were also apparently two other scam currencies, but these currencies were not named in the warning from Finma.

-

Chapter 4

Mining Bitcoin in Switzerland

The cost of purchasing expensive hardware aside, mining takes time and energy (literally) which gets expensive.

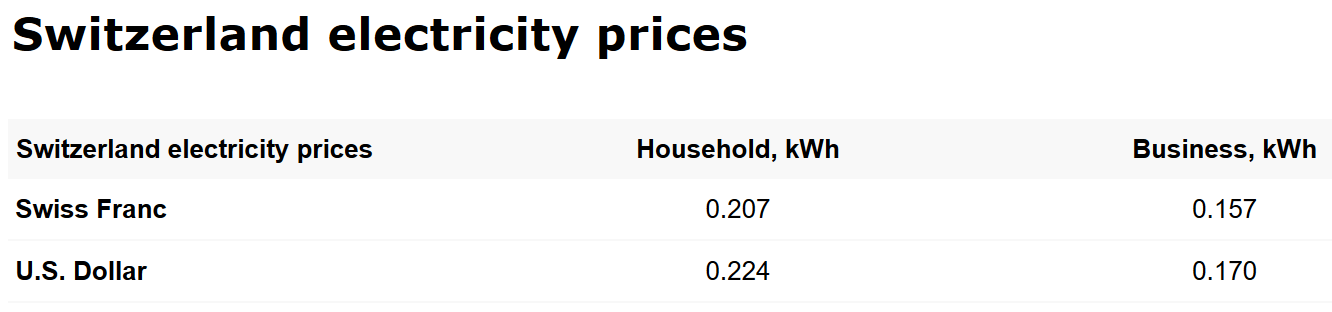

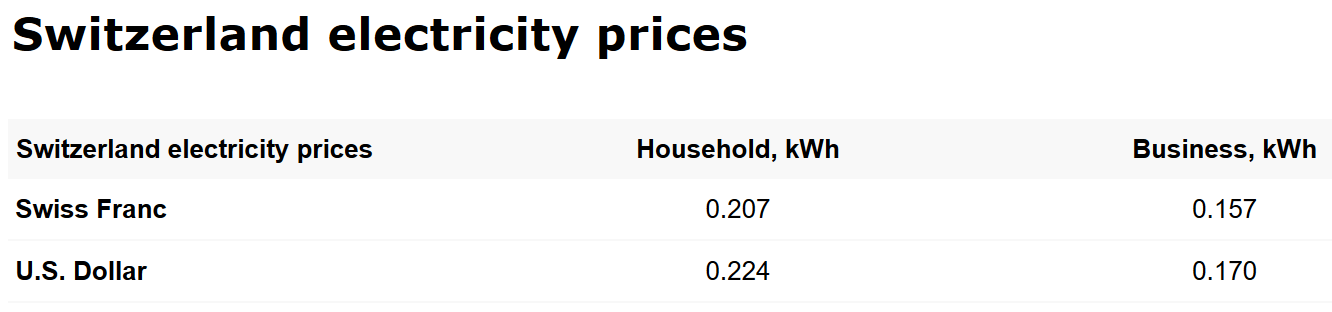

Especially considering the price of electricity in Switzerland, buying Bitcoin from one of the exchanges listed above is your best bet.

Swiss citizens pay roughly 0.20 Franks per kWh, nearly double the cost of electricity in the United States, where mining is also not profitable.

-

Does Coinbase work in Switzerland?

Citizens of Switzerland can convert, buy, and sell cryptocurrencies with fiat. Supported payment methods are:

- Bank Deposit

- PayPal

- 3D Secure Credit Card

- Debit Card

- Credit Card

Where Can I Find a Bitcoin ATM in Switzerland?

Switzerland is among the countries with the most Bitcoin ATMs per capita. At 103 ATMs across the country, you are never too far from a Bitcoin ATM, so if you want to stack some sats for cash, Switzerland is a great place to do it.

You can use our Bitcoin ATM finder tool to find the one nearest you.

What is the price of Bitcoin in Switzerland?

Bitcoin prices are changing every second.

The best way to find the most up-to-date price of Bitcoin is to check out our Bitcoin price page.

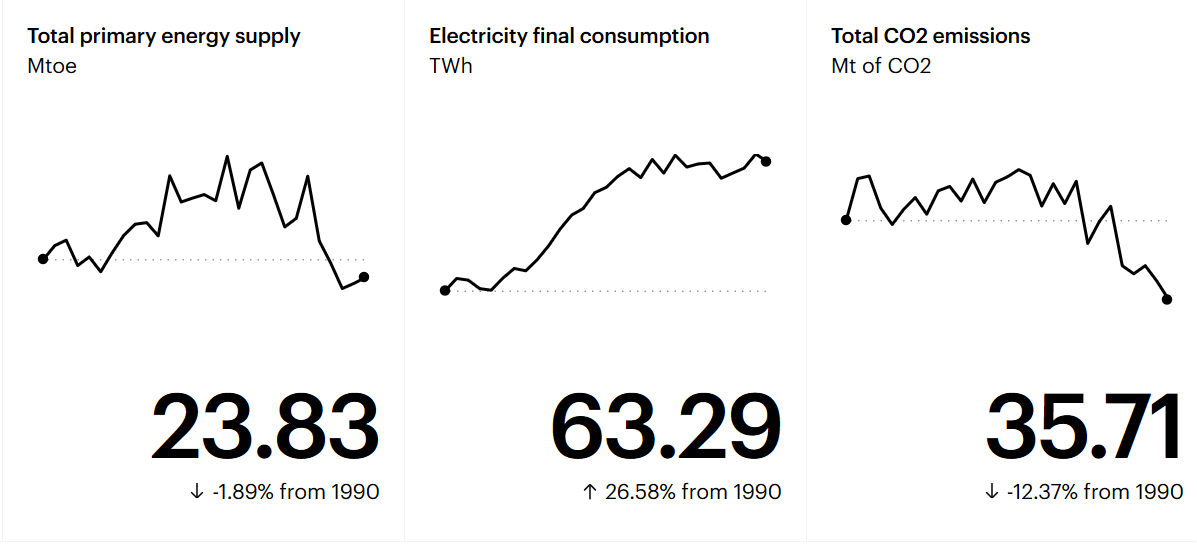

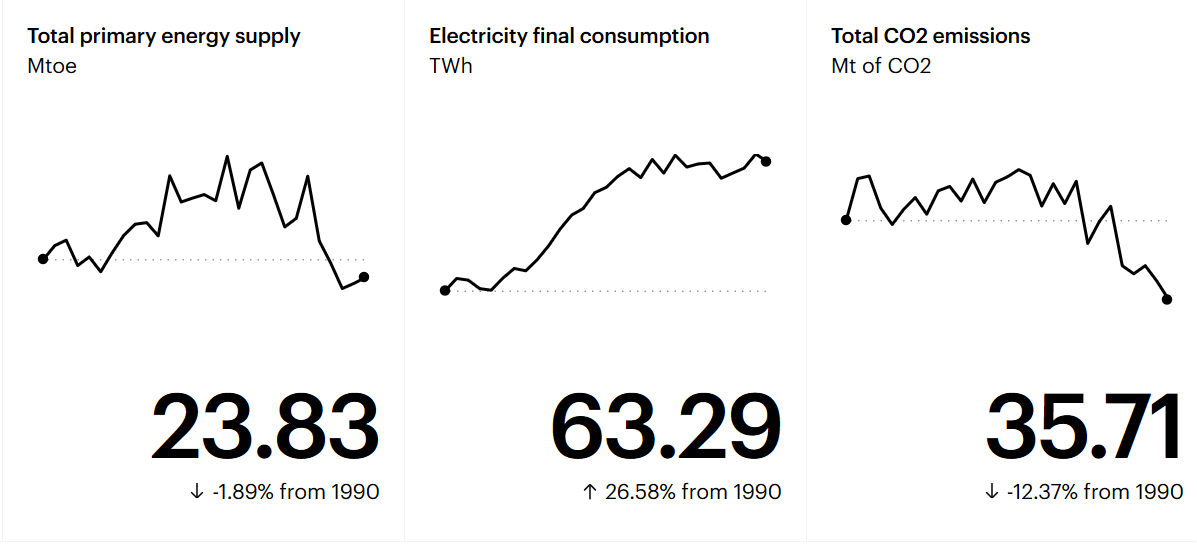

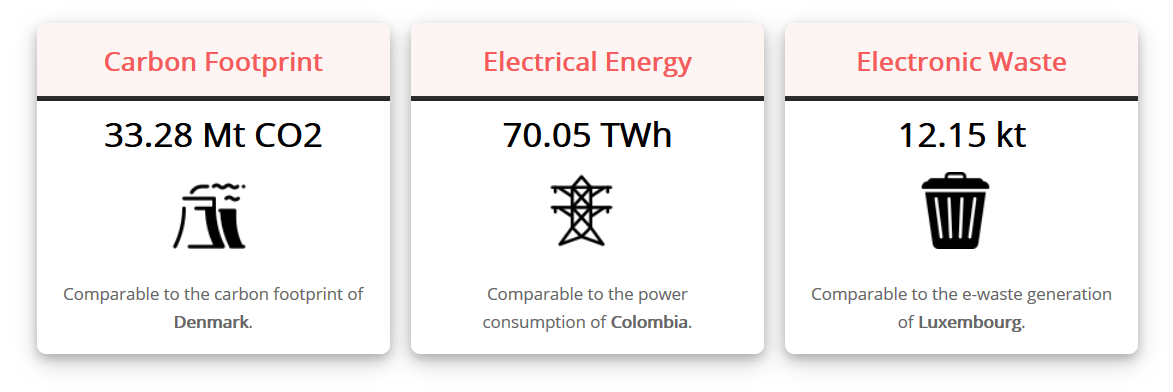

Does Bitcoin mining use more energy than Switzerland?

Switzerland currently consumes about 63 TWh of electricity every year while emitting around 35 Mt of CO2 each year.

According to the International Energy Agency, a non-profit that works with governments and corporations to secure sustainable energy policies internationally claims that Switzerland consumes about 63 TWh of electricity each year. It also emits about 35. Mt of CO2 each year.

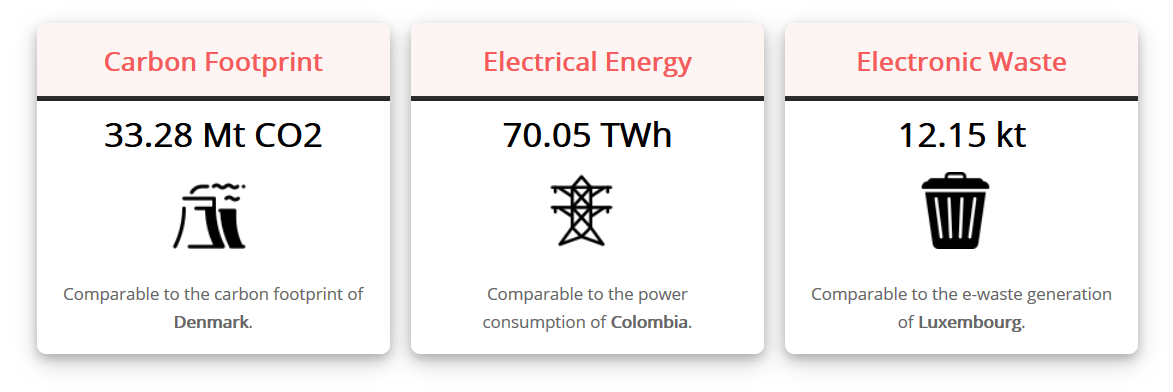

By contrast, according to Digiconomist, Bitcoin consumes about 70 TWh of electricity and emits ~33 Mt of CO2 each year.

That means that Bitcoin actually consumes more electricity that Switzerland consumes while emitting less CO2.

Is there a bitcoin ETF in Switzerland?

There are currently no Bitcoin ETFs in Switzerland.

What is crypto valley in Switzerland?

Crypto Valley is a city in Switzerland that was founded on the idea that companies, large and small, could move their headquarters to a place that is friendly to crypto startups. The city raised hundreds of millions of dollars to get the ball rolling, and indeed many startups did move there. However, in April of 2020, Swiss Blockchain Federation found that 80% of the 203 firms surveyed said bankruptcy was imminent and that only half of the 50 biggest companies in Crypto Valley would last another year.

In response to this, Crypto Valley management is turning to the Federal Government and asking for a 100 million Swiss Franc bailout to keep the project going. So much for decentralization!

Can you buy a house with Bitcoin in Switzerland?

Yes, you can currently buy homes and other property types with Bitcoin via Bithome.ch.

Where can I spend bitcoin in Switzerland?

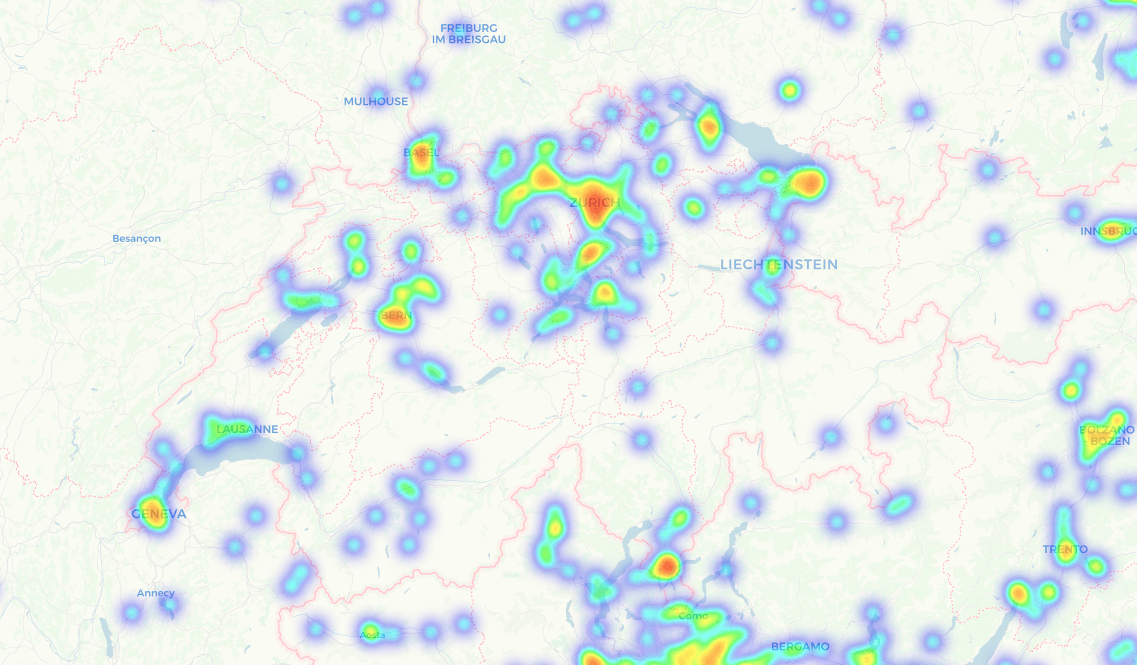

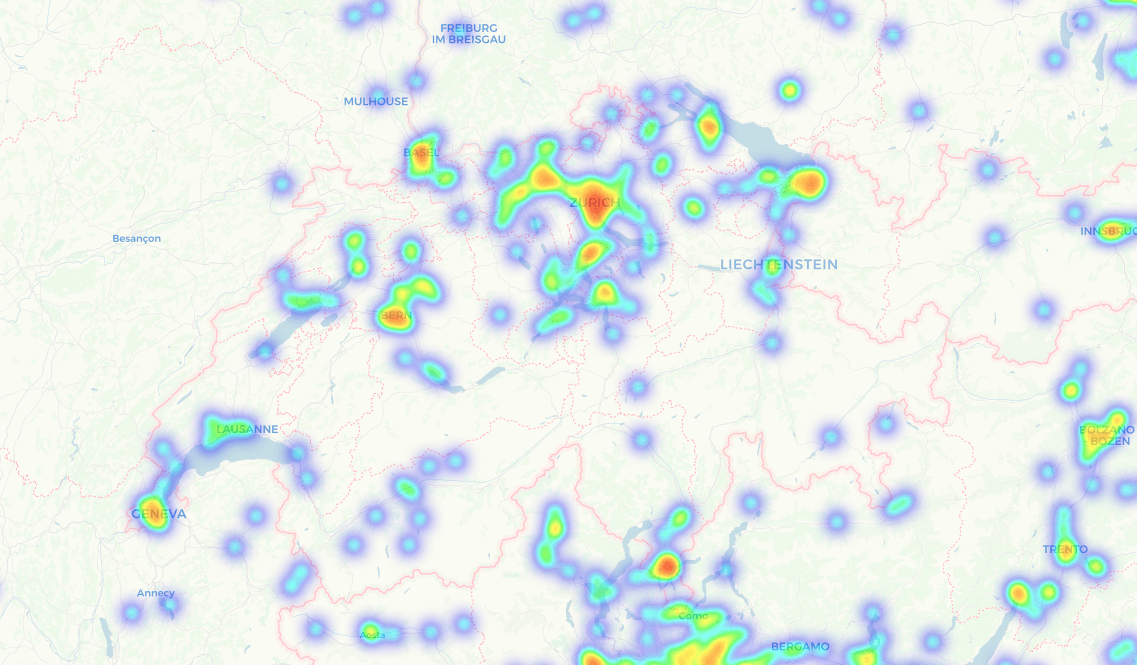

Bitcoin is accepted at lots of stores and service providers all over Switzerland. So many, in fact, that we couldn't possibly list them all here. However, you can find specific kinds of services and goods filterable on a map over at coinmap.org.

The colored sections indicate areas where there is heavier acceptance of Bitcoin

Which banks in Switzerland are bitcoin friendly?

Zurich-based SEBA Bank AG offers a suite of services for crypto enthusiasts, such as crypto custody and crypto-connected debit cards.

Falcon Group also offers these services as well as Bitcoin savings and brokerage services.

Article Sources

BuyBitcoinWorldWide writers are subject matter experts and base their articles on firsthand information, like interviews with experts, whitepapers or original studies and experience. We also use trusted research and studies from other well-known sources. You can learn more about our editorial guidelines.

- Startup.ch - Bitcoin Suisse AG, https://www.startup.ch/Bitcoin

- Swissinfo.ch - Swiss banks remain wary of bitcoin, https://www.swissinfo.ch/eng/business/swiss-banks-remain-wary-of-bitcoin/48295598

- Bitcoin Magazine - You Can Now Live In This Swiss City Solely On Bitcoin, https://bitcoinmagazine.com/culture/live-in-swiss-city-solely-on-bitcoin

Finma

Finma