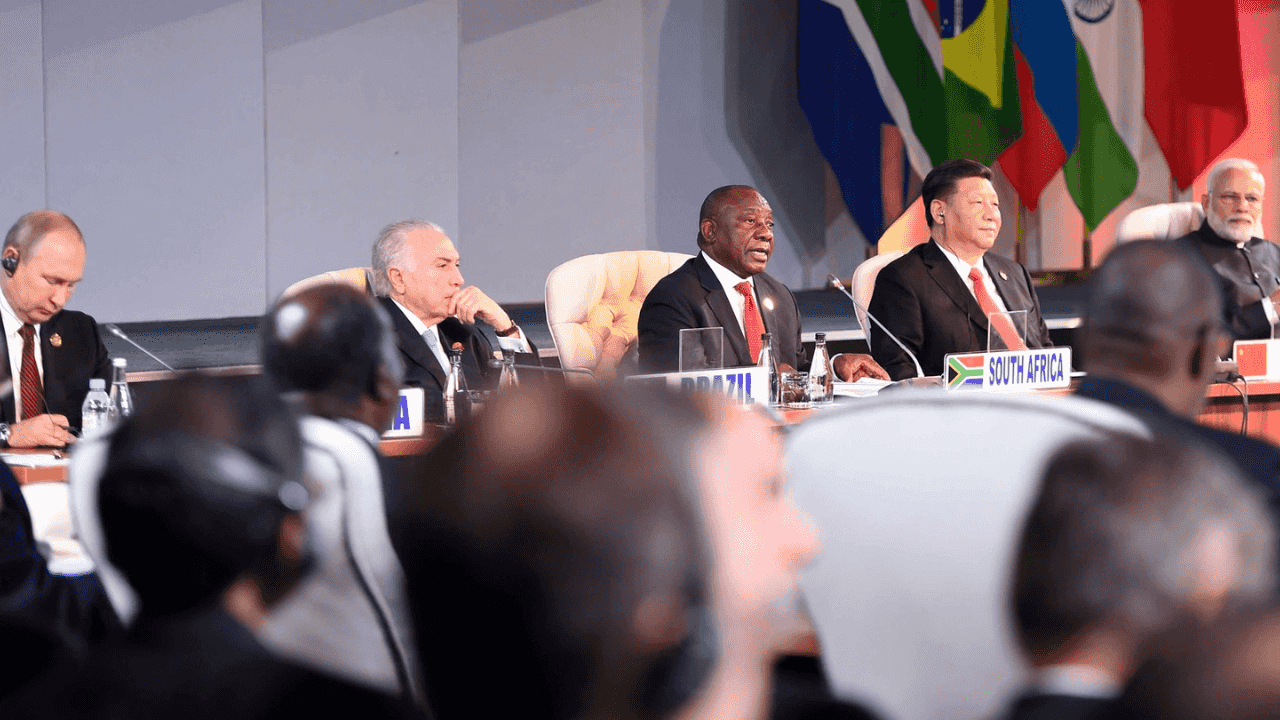

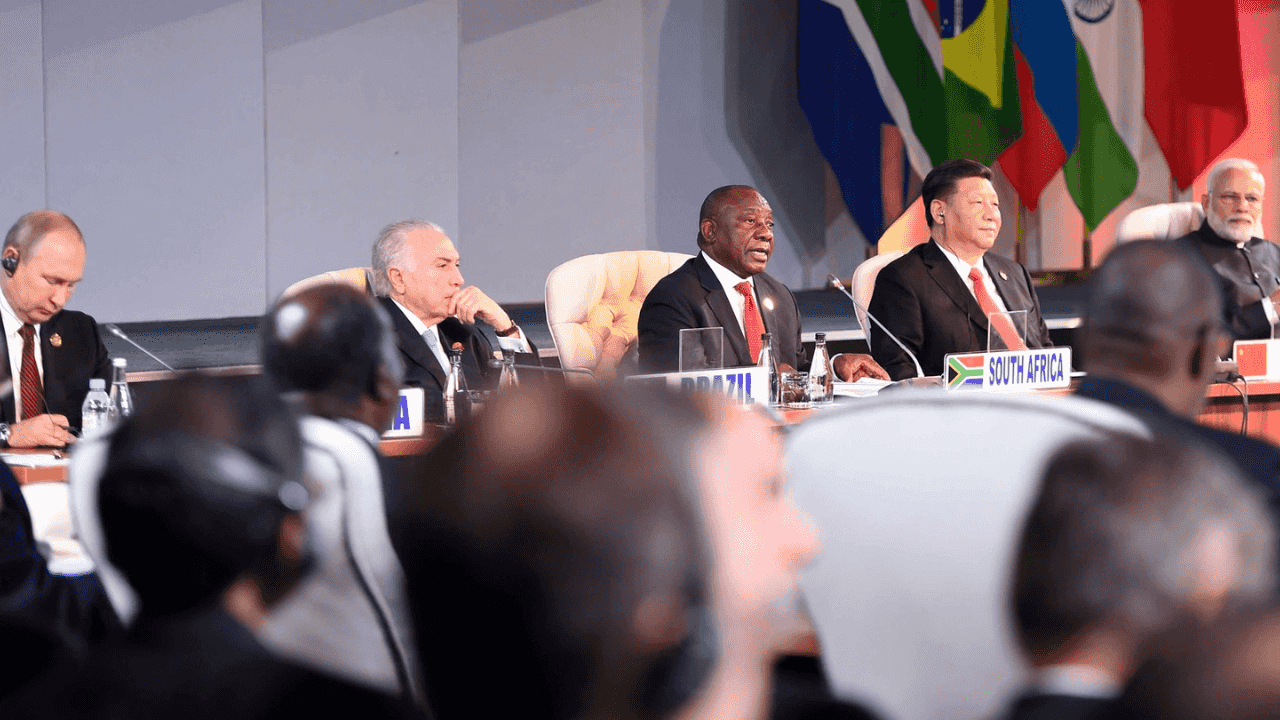

JOHANNESBURG, SA - The BRICS Summit in South Africa this week faced some challenges as member states negotiated on processes for expansion and adding new member nations. Though the coalition’s leaders have voiced support for expansion, disagreements persist, especially regarding the pace and conditions of such growth.

Conflicting Visions of the World

Central to this expansion ambition are Beijing and Moscow’s hopes to position BRICS as an alternative to Western alliances. Yet the diverse economic trajectories and foreign policies of member states, combined with their consensus-driven decision-making, add layers of complexity to swift decision-making. China, with its vision of a multipolar world, contrasts sharply with Russia’s aim to augment its influence. Meanwhile, both Brazil and India seem to be tilting towards stronger relations with Western nations.

South African Foreign Minister, Naledi Pandor, expressed optimism about the summit’s outcomes, stating, “We have a document that we’ve adopted which sets out guidelines, principles, and processes for countries eager to join BRICS.” Yet, the introduction of new membership criteria by Indian Prime Minister Narendra Modi has seemingly caused delays. The interest in BRICS membership is palpable, with over 40 nations showing interest and 22 having formally applied.

Network Effects and Hurdles to Come

The dominance of a single currency as the global medium of exchange comes down to a simple feedback loop: it is easiest to trade with the most traded currency and so the most traded currency is traded more. Put another way - globally dominant currencies enjoy a network effect. If you are from Grenada and you want to trade with someone from Finland, you have a problem - the Fin you want to buy from probably doesn’t want your money. But he probably will take U.S. Dollars and there are lots of U.S. dollars that want to exchange for your East Caribbean dollars (the currency of Grenada).

The task of the BRICS nations is upend this efficiency by introducing a new international currency to enable dollar-free trade (or choose the Yuan as the global ‘go-to’). Both of these are unlikely. Any country opting to use the new currency would be seen as sanction evading due to Russia’s war in Ukraine and a Yuan dominant BRICS currency would put Beijing’s currency control interests at odds with those of the union.

All of this is to say: if you want your currency to be the global currency of trade, you need it to be open, relatively stable, and widely desired. And nearly none of these apply to BRICS currencies. A BRICS movement may chip away at dollar dominance on the margin, but it’s probably no serious threat to the dollar’s dominance in global trade.

BRICS and Bitcoin

So that brings us to Bitcoin. How should we view this BRICS movement in terms of Bitcoin’s role in the global economy? Well, first of all, Bitcoin is the most open, borderless currency on the planet. There is a large demand for it in nearly every country. And…at least lately, it has been very stable, and it only get more stable as time goes on. Bitcoin is also very difficult to sanction since it is permissionless. With all that said, anything that chips away at dollar dominance creates room at the table for other contenders to come in and compete. So if you ask me, a stronger BRICS alliance is good for Bitcoin, however that turns out.

Get Smarter About Bitcoin

Bi-weekly newsletter featuring the latest Bitcoin-only news, analysis and price updates.