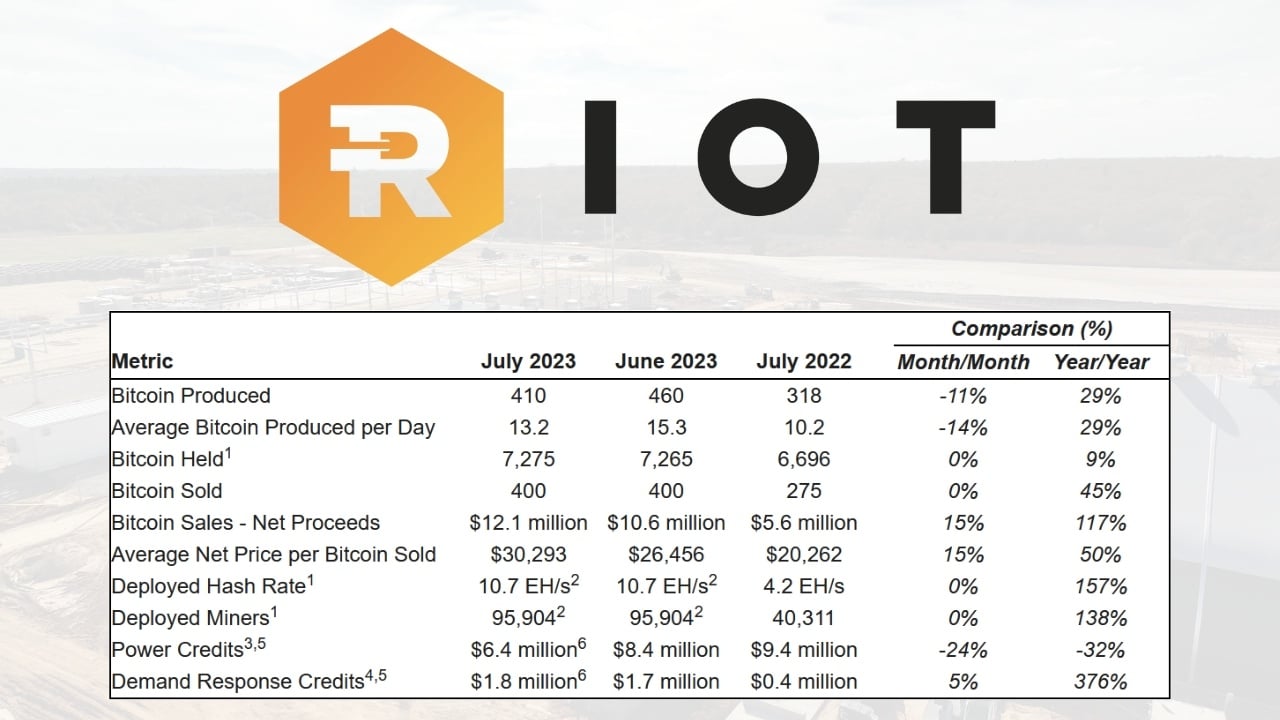

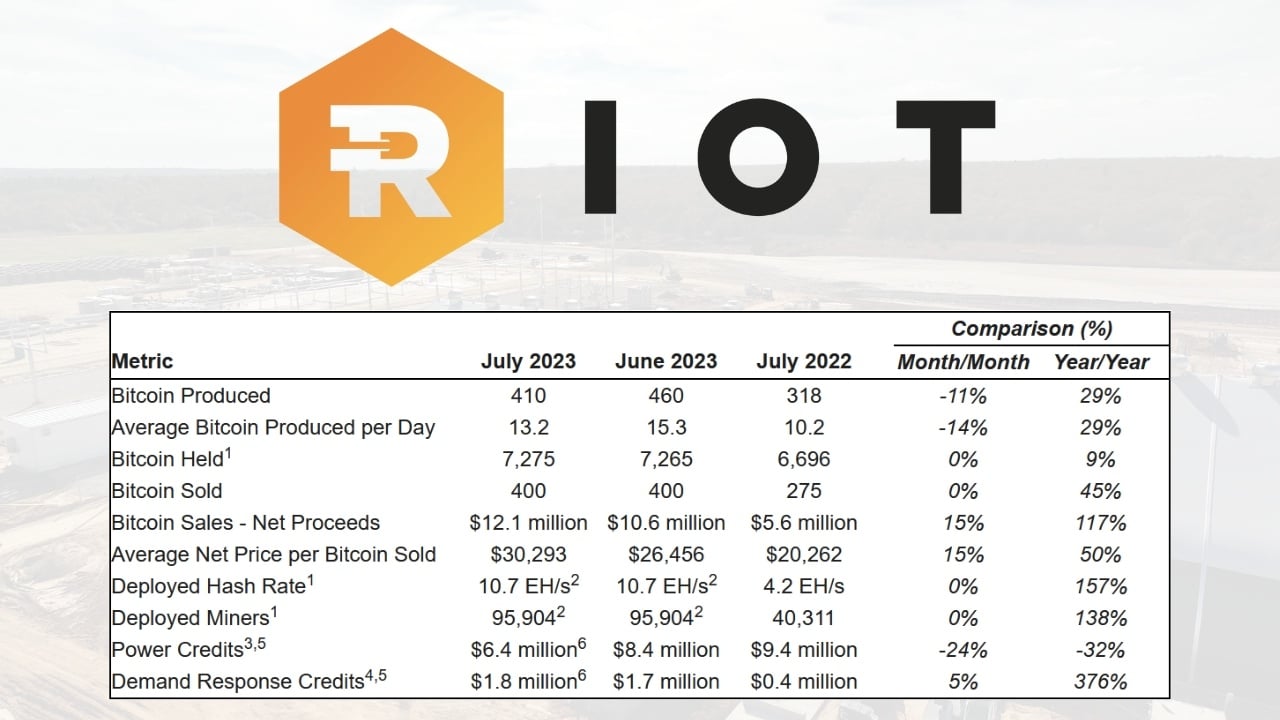

In a recent update on its production and operations for July 2023, Riot, a Bitcoin mining company, announced that it had mined 410 Bitcoin. While this is certainly significant, the more intriguing part of the announcement is how much the company earned not mining Bitcoin. Over the months of June and July, Riot claims to have accumulated $14.8 million in power credits and an additional $3.5 million in demand response credits.

Trading Electricity for Profits

The sizable amount earned in power credits comes from Riot’s ability to sell back their in-house power generation to the electric grid when prices peak. Additionally, the demand response credits were garnered as part of a bonus system set up for power consumers participating in the Electric Reliability Council of Texas (ERCOT). ERCOT awards these credits to participants who agree to cease power consumption when directed to do so, helping to alleviate grid strain on particularly hot days. Given that June and July were packed with such days, Riot capitalized on the opportunity.

Balancing Profit and Public Utility

While these figures are estimates and should be taken with a grain of salt—especially considering Riot’s vested interest in reporting high numbers—the claims likely bear a good deal of accuracy. Furthermore, the numbers suggest that Riot is significantly benefiting from these energy management incentives offered by the Texas power grid. It also highlights the intriguing possibility that Bitcoin miners could play a role in grid stabilization, a topic gaining attention in energy policy debates.

In a statement, Riot CEO Jason Les said, “Riot had another strong month in July amidst some of the most challenging operating months of the year….Our team was able to navigate rapidly changing power market and Bitcoin mining conditions in order to maximize value on a real-time basis through our power strategy.”

Companies like Riot are proving that there’s more to Bitcoin mining than just the hunt for digital gold. Their financial strategy shows that they’re not only in the game to mine Bitcoin but also to integrate sustainably and profitably within the broader energy ecosystem.

Get Smarter About Bitcoin

Bi-weekly newsletter featuring the latest Bitcoin-only news, analysis and price updates.